Popular Line of Credit Software

Popular Line of Credit Software

Managing finances is crucial for the growth and stability of any business, especially for small and medium enterprises. One of the tools gaining popularity among business owners is line of credit software. These platforms are designed to help users access, manage, and track revolving credit in an organized and efficient manner.

Line of Credit Software

Line of credit software is a financial tool or platform that allows businesses and individuals to manage a line of credit—an arrangement with a lender to borrow up to a certain limit, repay it, and borrow again. Unlike traditional loans, lines of credit are flexible and can be reused, making them ideal for short-term funding needs and cash flow management.

Benefits to Small Business Owners

For small business owners, maintaining healthy cash flow is a constant challenge. Line of credit software offers several benefits:

- Quick Access to Funds: Enables businesses to draw funds as needed without reapplying for a new loan.

- Better Financial Planning: Provides real-time visibility into available credit, balances, and repayment schedules.

- Automated Alerts: Sends reminders for repayments and alerts for due dates or credit utilization thresholds.

- Credit Line Optimization: Helps identify the best time and amount to borrow to avoid overuse or underuse of credit lines.

- Integration: Often integrates with accounting or ERP systems to streamline financial operations.

Popular Software

Some of the widely used line of credit software solutions for small to mid-sized businesses:

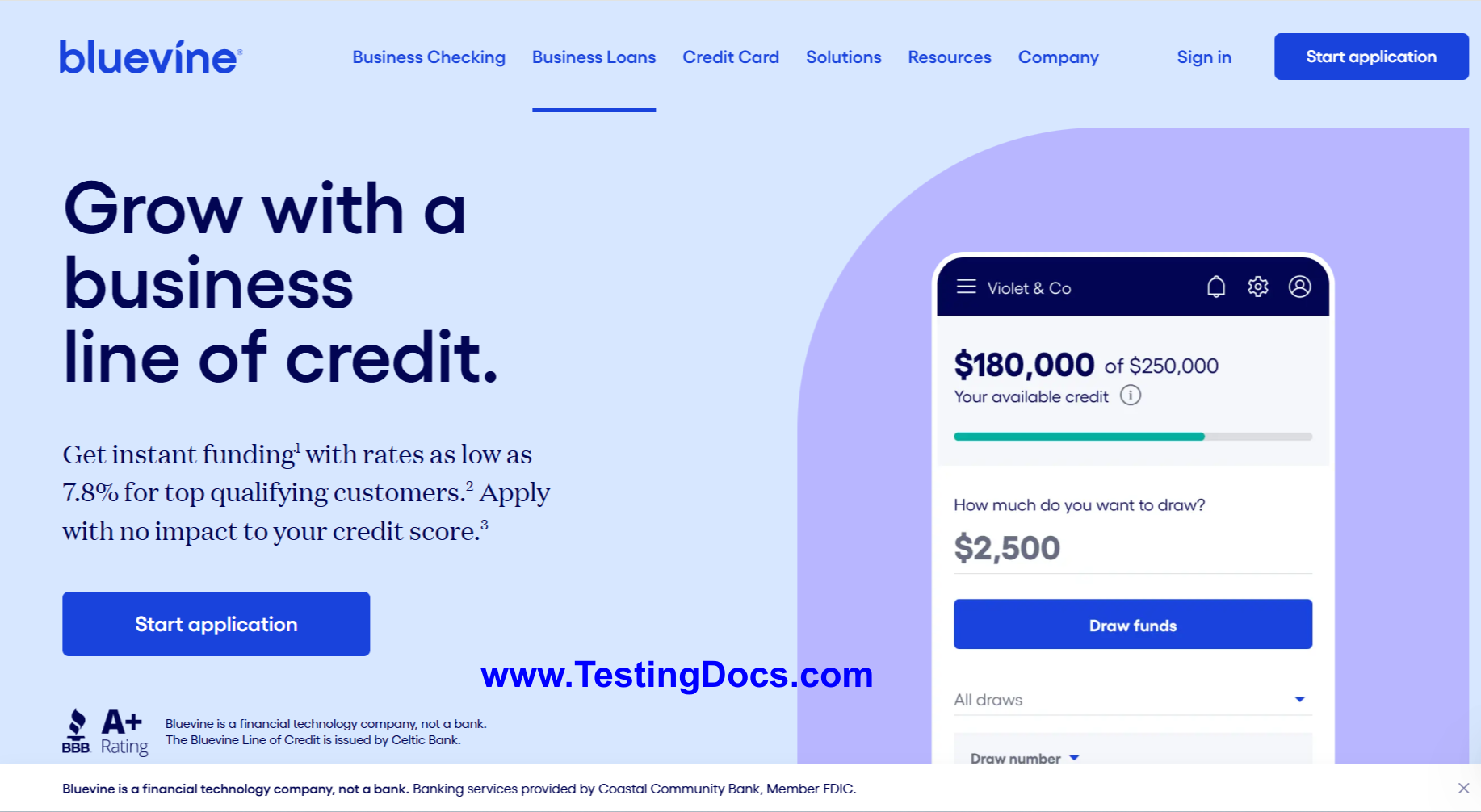

- BlueVine: Offers flexible credit lines and an intuitive dashboard to track spending, repayments, and available credit.

- Fundbox: Provides easy-to-use credit lines with fast approval and integration with accounting tools like QuickBooks and Xero.

- Kabbage (by American Express): Delivers revolving credit lines and analytical tools for business performance tracking.

- OnDeck: Specializes in short-term loans and lines of credit for small businesses with a strong online management portal.

Choosing the right line of credit software can significantly enhance a business’s financial agility and decision-making ability. As more businesses go digital, these tools are becoming essential for day-to-day financial management.