Credit Card Credit Limit

Overview

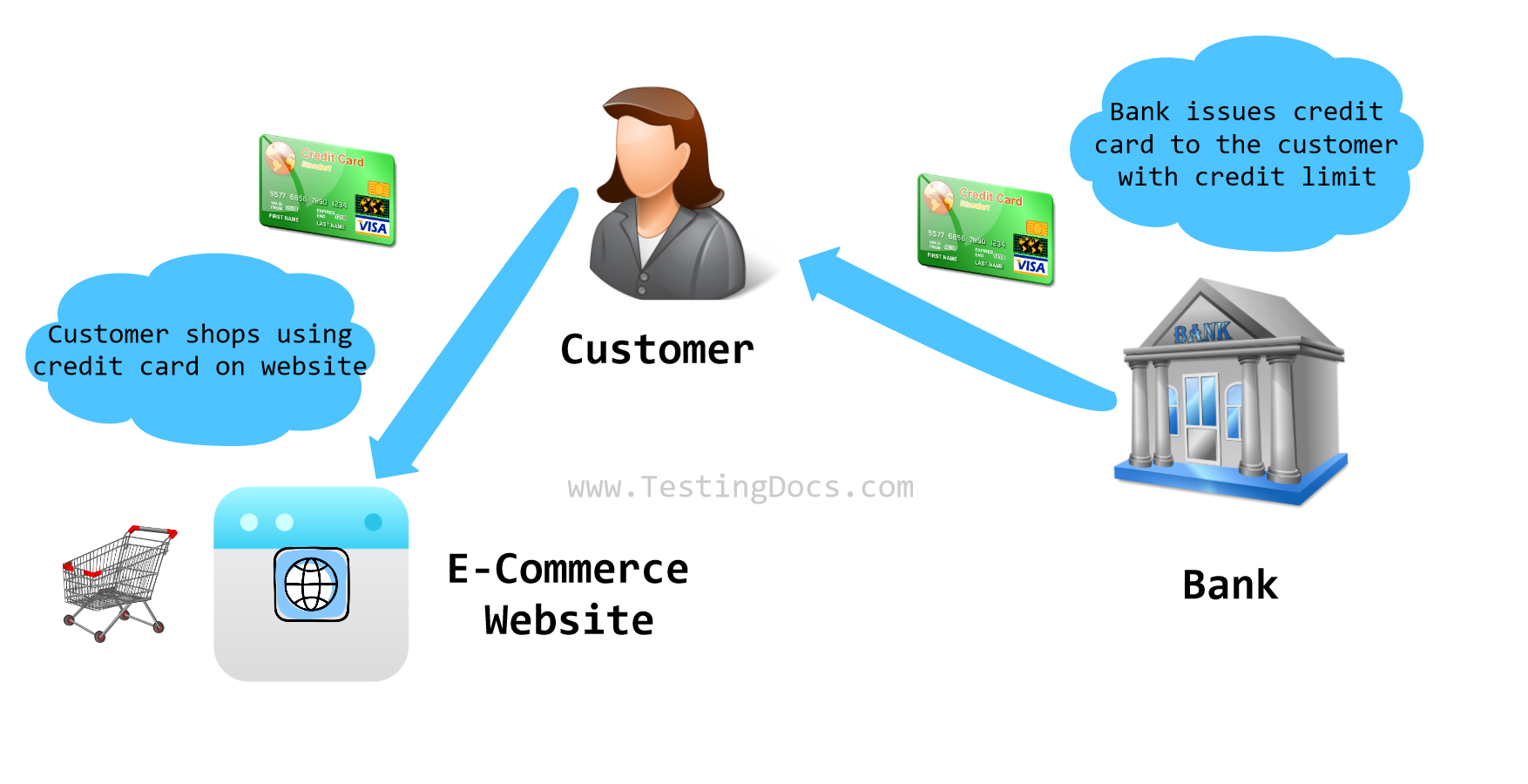

The Credit Limit is the maximum amount a cardholder can borrow on a credit card. A credit card is a plastic payment card issued by a financial institution, such as a bank, allowing the cardholder to borrow funds to make purchases. The cardholder can use the credit card to make transactions at various brick-and-mortar merchants and online e-commerce websites up to a predetermined credit limit set by the issuer.

What is a Credit Limit?

A credit limit is the maximum amount of money that a credit card issuer allows a cardholder to borrow on a particular credit card account. It represents the cap on the total outstanding balance the cardholder can accumulate through purchases, cash advances, or balance transfers.

The credit card issuer determines the limit based on various factors, including the cardholder’s creditworthiness, income, and credit history.

A cardholder can hold multiple cards from the same bank. The bank assigns one primary card to the cardholder; the other cards are called add-on cards.

Single Credit Card

Suppose Mr. X has one credit card with a credit limit of $ 30,000

The maximum expenditure allowed to Mr. X is $ 30,000

Multiple Credit Cards

Suppose Mr. X has three credit cards

- Credit Limit of Credit Card A = $ 20,000

- Credit Limit of Credit Card B = $ 30,000

- Credit Limit of Credit Card C = $ 10,000

The maximum expenditure allowed to Mr. X collectively from credit card A + B + C is less than or equal to $ 60,000

Credit cardholders must understand their credit limits and use their credit cards wisely to maintain a positive credit history.