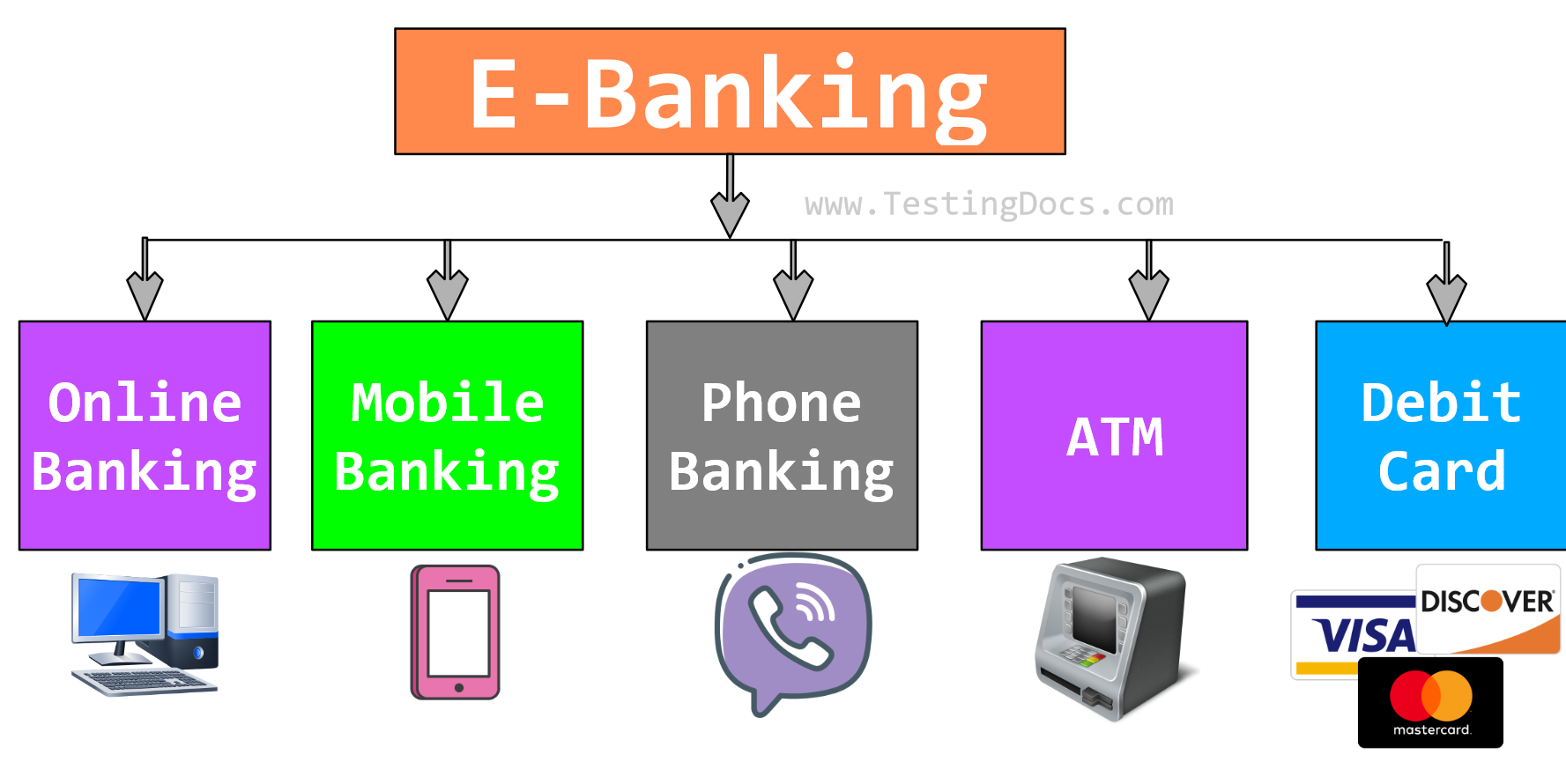

Types of E-Banking

Overview

In this tutorial, we will learn about the different types of E-Banking, which also refers to Electronic Banking. E-banking is the financial and payment services delivered to customers using electronic devices and terminals on a computer network, like the Internet, Wireless networks, Automatic Teller Machines (ATMs), and Fixed telephone networks.

Types of E-Banking

The different types of E-Banking are as follows:

- ATM

- Internet Banking

- Mobile Banking

- Phone Banking

- Debit/Credit Card

- Self-service terminals

- Contactless Payments, etc.

ATM

Automated Teller Machine(ATM) is one of the most popular types of electronic banking. The teller machine is also an electronic computerized telecommunication device that lets you withdraw funds, deposit funds, change your Debit Card PIN(Personal Identification Number), and use other banking services. ATM eliminates the need to visit a bank and do these financial transactions through a human teller at the bank.

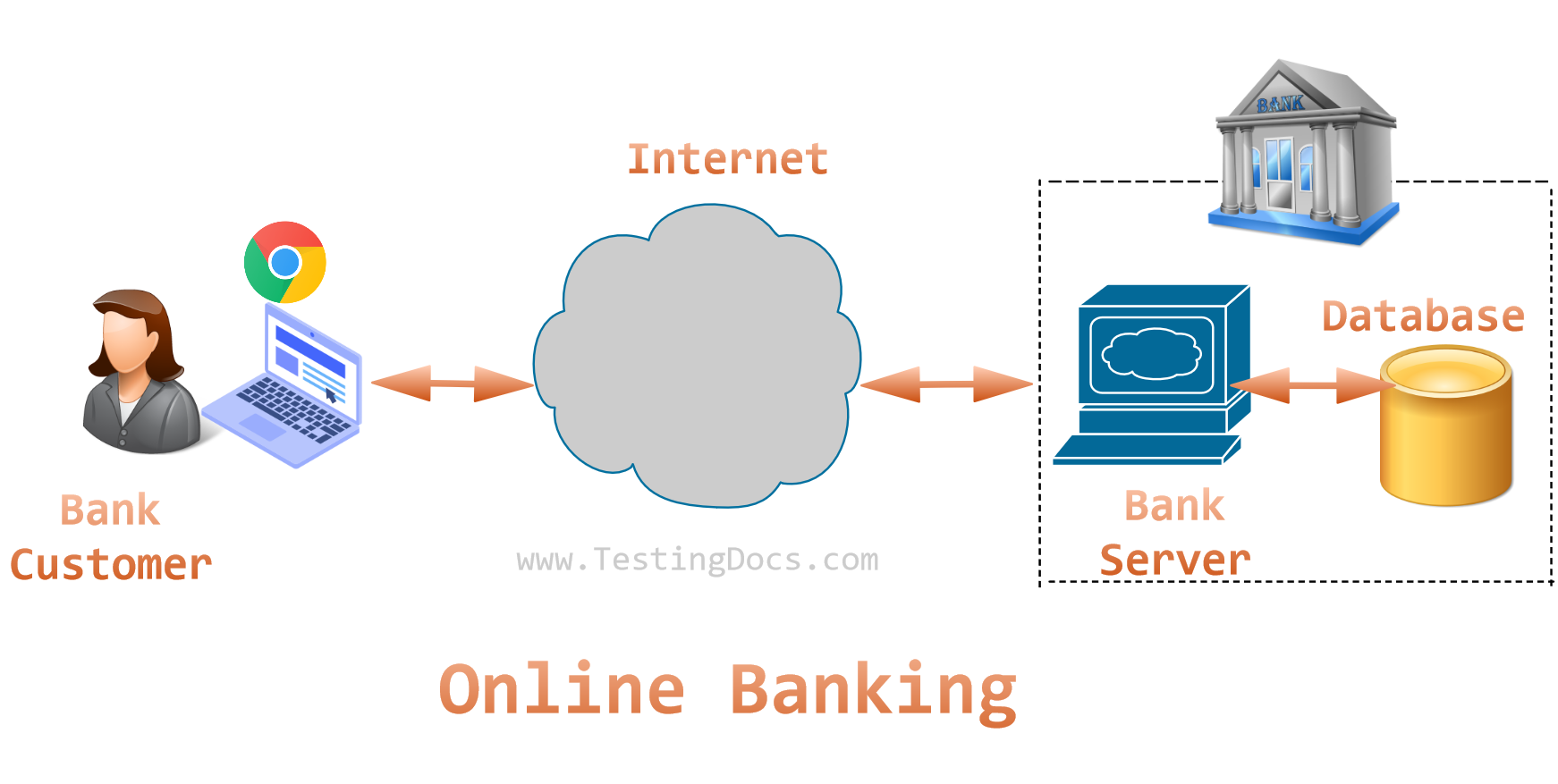

Internet Banking

Internet banking refers to financial services delivered over the Internet to customers’ devices, including personal computers like desktop computers, laptop computers, notebook computers, mobile devices such as smartphones or tablet computers, or other devices.

The bank hosts and runs the banking application on its servers. The customer visits the banking application online using a web browser and his/her user credentials to perform financial transactions.

Mobile banking

Mobile banking refers to services provided through a mobile smartphone application or m-website. Customers download mobile banking applications from mobile application marketplaces like Google Play stores or Apple Stores.

Phone Banking

Phone banking refers to banking services provided through a fixed telephone line or mobile telecommunication network. The most popular phone banking service is the automated Interactive Voice Response (IVR) banking service.

Debit/Credit Card

Debit and Credit Cards are other types of E-banking. A debit card is connected to your bank account, and you can use the funds from your account directly through this card. Credit cards are issued by banks based on your credit score with a predefined credit limit.

When you use your Debit Card for a financial transaction, the amount is deducted from your bank account. You can use the card to pay at POS(Point of Service), brick-and-mortar merchant outlets, shop online, withdraw cash from ATMs, etc.

Self-service terminals

Self-service terminals are interactive kiosks used by AI (Artificial Intelligence) to provide financial services, including ATMs, cash deposit machines, and virtual teller machines.

Contactless Payments

Contactless mobile payments refer to the use of contactless or wireless technology. An example of contactless technology is Near Field Communication (NFC). Contactless payment is used to transmit transaction information (e.g., credit card information) between the customer’s mobile device and the merchant payment device.